Play Video

Play Video

Grow your accounting firm with CoinTracking

Since the United States and most other countries treat cryptocurrencies as property at tax time, adding cryptocurrency to your list of supported services may not require as much expertise as you think. You can apply the same basic tax rules and methodology that you may already use, if you help your clients with stocks and other similar assets.

Even if you have just a little or even no cryptocurrency experience, a CoinTracking Corporate subscription can help you expand your business and help meet the growing demand for cryptocurrency tax services. Our software takes care of the hard part of figuring out cryptocurrency taxes - importing and structuring data from crypto exchanges.

CoinTracking imports your customers’ trading data and crunches the numbers for you. All you have to do is help your clients check everything and make sure that they submit all the forms they need to file. CoinTracking can even generate several tax forms automatically.

Fast and easy cryptocurrency exchange imports

CoinTracking was the very first cryptocurrency tax software solution to hit the market. Before CoinTracking, CPAs had to have their clients manually export all their cryptocurrency trading data to custom-made spreadsheets. CoinTracking offers a better solution. Our software imports all the required data, so that you can generate tax reports instantly.

We have better support for automatic transaction imports than any other cryptocurrency tax tool. Once your client links all their cryptocurrency exchange APIs to CoinTracking, you’ll have all the basic data you need to file their taxes. Any cryptocurrency exchanges you connect with, will refresh once per day automatically. You can also trigger a manual update every hour.

Add clients that already use CoinTracking to your account

If your client already uses CoinTracking, you can add their account to yours with just a few clicks. This will give you full access to all your client’s records. From there, you’ll be able to generate tax reports, perform audits, add additional data and more.

Many tax professionals add our logo to their website. When one of our many customers sees that, they know they will be able to share their trading data with you with ease. With over 360,000 users, CoinTracking is the most popular cryptocurrency tax solution on the market.

Pricing:

Base price incl. 10 Unlimited Accounts: $1199 / Year

Additional Accounts:

$109 / Account / Year (11-50 Accounts)

$99 / Account / Year (51-100 Accounts)

$89 / Account / Year (101-200 Accounts)

$79 / Account / Year (201-500 Accounts)

$69 / Account / Year (501+ Accounts)

Receive discounts when you buy CoinTracking subscriptions for your customers

When you buy a corporate account, you’ll get ten CoinTracking accounts that you can give to your clients. Since the base price is $1199, that’s only $119.90 per account.

If you get more cryptocurrency clients and you need more accounts, you can purchase additional ones. The more accounts you buy, the more money you’ll save.

The normal price for one year of CoinTracking Unlimited is $659. But as a corporate client, you’ll pay just $109 per additional account after you use up the ten that you get with the base plan. That price drops to $99 when you buy more than 50 accounts. Large tax firms that buy more than 500 accounts pay only $69 per additional account.

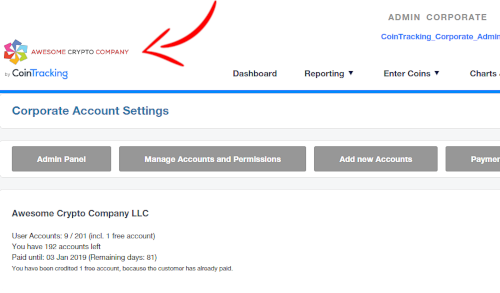

Insert your logo on the top left part of the interface

When you give a customer access to one of your CoinTracking accounts, they’ll always see your logo on the top left part of the screen every time they log in. This branding provides a visual reminder that they can contact you if they need tax advice as they go through the process of uploading their data from all their exchanges and wallets.

Process an unlimited number of transactions

When a professional cryptocurrency trader comes to you with a million or more transactions to process, you’ll need a powerful cryptocurrency software solution that is capable of crunching those kinds of numbers. All our corporate customers can process an unlimited number of transactions and create as many tax reports as they need.

Powerful accounting features

CoinTracking offers several detailed tools that most other cryptocurrency tax calculators lack.

- Multiple cost basis accounting methods. Most cryptocurrency tax calculators only support a few accounting methods, but we support 12. We even support the specific accounting methods used in Canada or the UK.

- Fincen 114 (FBAR). CoinTracking is one of the only cryptocurrency tax calculators that supports FBAR (Foreign Bank Accounting Report). Your client will need to file an FBAR if they held more than $10,000 of equivalent currency in a foreign exchange.

- IRS form 8949. Most cryptocurrency tax calculators can export IRS form 8949, but CoinTracking lets you customize the way your transactions are listed on the form. You can either group the transactions by coin or list out each transaction separately.

- Compatible with a wide range of popular tax software platforms. You can send your data to the desktop version of TurboTax, TaxACT, Drake or WISO. Any CoinTracking report can be exported to Excel or CSV.

CoinRacoon integration - Accounting software for crypto transactions in Germany

By using CoinTracking as a company in Germany, you also have the option to use CoinRacoon as a complementary service tool.

CoinRacoon is a software solution developed by the law firm WINHELLER to support companies trading cryptocurrencies or accounting cryptocurrencies with their financial accounting. With the help of CoinRacoon, complicated processes and thousands and thousands of crypto transactions, which are tracked with the help of CoinTracking, can be automatically and legally transferred into the financial accounting of your company.

CoinRacoon is useful in all those cases where companies perform a large number of crypto transactions that are relevant for financial accounting and need to be transformed into accounting records accordingly. Find out more here!

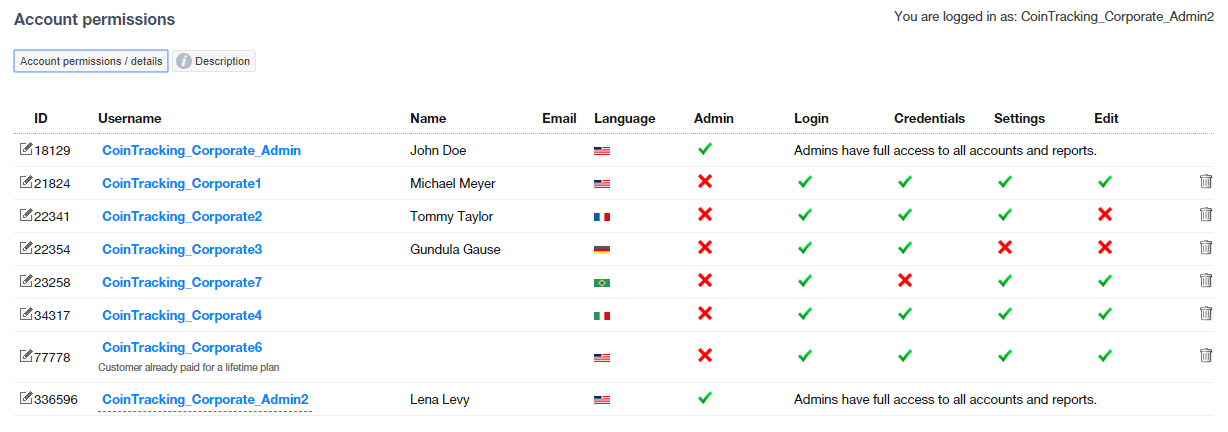

Set up permissioned CoinTracking accounts for each of your employees

When you’re ready to grow your business and add employees, CoinTracking can grow with you. You can set up permissioned accounts for each of the accountants that works at your firm. This will give everyone at your business access to CoinTracking’s powerful features.

Sub-accounts that you designate as employee accounts can add new clients and access existing clients’ data. However, employee accounts can only edit data, if an administrator account gives them permission to do so.

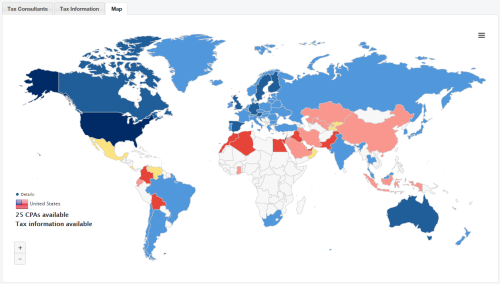

Gain access to an entirely new pool of potential clients

Our users often ask us detailed questions about the tax policies of various governments around the world. To help them find answers, we regularly refer them to the tax professionals that we rely on for advice.

We recently started building a database of experienced cryptocurrency tax professionals to help answer their questions. You can be a part of that for free. All you have to do is scroll down to the bottom of this page and click the “Add your Tax Consultant / CPA company to this list” button. This will bring up a short form. From there, just provide us with your company’s name, website, logo and a short bio and we’ll add your company to the database.